This week, popular free online budget site Mint.com launched a new tool that helps people figure out when they could be out of debt and keeps them updated on their progress.

I’ll explain how it works, along with its pros and cons, in a minute. But first, a little background.

Making Budgets Cool

When Mint and several competitors launched a few years ago, they did what I never thought possible; they made it appealing to use a budget. This has long been a tough sell, but by bringing budgeting online, the idea caught on quickly. Today, Mint has almost five million users.

The main barrier for people is that you have to enter all of your bank account and credit card passwords (see my previous post, Is Mint.com Safe?). If you’re comfortable doing that and are then willing to spend a little time setting up a budget, Mint will quickly and easily show you how your actual spending in each spending category compares with your planned spending.

We use Mint in our household and have been mostly happy with it. Most mornings, I log in for a few minutes to see how we’re doing, make sure our most recent transactions were categorized correctly, and then manually enter any cash transactions.

Steady Improvements

Mint rolls out new features on a regular basis, and last summer launched a Goals tab, where you could choose among nine goals, such as buy a home or get out of debt. It then suggests a series of next steps and tracks your progress.

Since the Get Out of Debt goal was, by far, the most popular, and because revolving debt like a credit card balance is a different animal than installment debt like a student loan, the company decided to split the Get Out of Debt goal into Pay off Credit Card Debt and Pay off Loans.

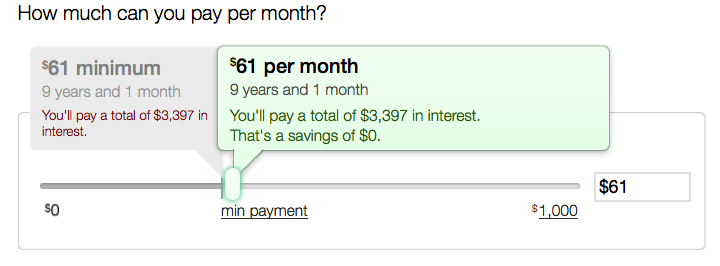

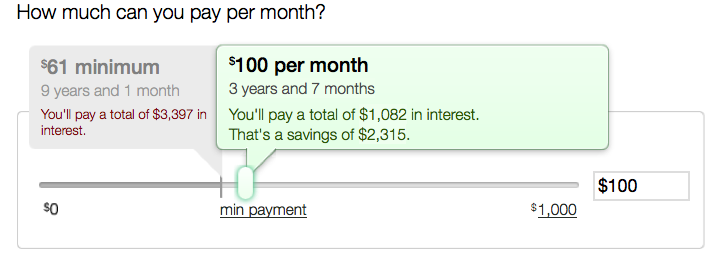

If you choose the Pay Off Credit Card Debt goal, Mint will show you each of your credit cards along with their current balances, ask you which ones you want to pay off, and then instruct you to fill in the interest rate and minimum due. When you’re done, it will show you how long it will take you to get out of debt if you make just those minimum payments.

By moving the slider, you can easily run other what/if scenarios, showing how much more quickly you’ll be out of debt if you pay more than the minimums.

Which Debt to Pay Off First

There’s a perennial debate among personal finance teachers as to whether it’s best to pay off your highest interest rate debt first or the one with the lowest balance.

Some people, myself included, recommend going after the lowest balance debt first, pointing out that it feels good to knock out one of your debts as soon as possible. It’s an emotion-based argument. The assumption is that making fast progress will give you the motivation to keep going.

Others recommend going after the highest interest rate debt first, reasoning that doing so will get you completely out of debt the fastest and cost you’re the least amount in interest. When I’ve run different scenarios, I’ve found that this is, indeed, the approach that will get you completely out of debt the fastest and with the smallest interest cost. However, the savings of time and money are relatively small compared with going after the lowest balance debts first.

Mint’s system creates a payment plan focusing on paying off the highest interest rate card first.

Aaron Forth, Vice President of Product in the Personal Finance Group at Intuit, which owns Mint, told me, “It was a debate that was had passionately.” He explained that the folks at Mint tend to be “a quantitative bunch,” so it’s natural that they would set up the system to go after the highest rate debt first.

But they’re not all numbers and no heart. After someone pays off a debt, Mint is set up to send a congratulatory e-mail. Figuratively speaking, Forth said Mint “used to yell at people for going over budget… Now, we’re giving them a pat on the back for paying off their debts.”

Still a Bug or Two

I was able to test Mint’s new Pay Off Credit Card Debt goal since we have three credit cards (of course, we pay our balances in full each month), and I found a few issues.

Most importantly, after entering all of our information, it came up with this ill-advised suggestion: “Keep yourself in check: Consider using your E HEALTH SAVINGS NOW debit card for purchases.” That’s our health savings account, which is only to be used for medical expenses. We have a debit card attached to our regular checking account, which is the one it should have recommended.

In the past, when Mint has added new features, they have had a few bugs. I trust they’ll get things smoothed out soon enough.

“Minimum Payments” Needs Clarification

One last point has to do with Mint’s advice about making your “minimum payments.” Let’s say you have multiple credit card debts and you wisely decide to pay more than the minimum. While applying that extra amount to one of your cards, Mint reminds you to keep making your minimum payments on all of your other cards.

But here’s the somewhat confusing issue: there are two types of minimum payments: a “fixed” minimum and a declining minimum.

If you stop using a card and pay the minimum amount required each month, then each month the card company will require a little less of a payment. That’s because your balance is declining a little bit each month and your minimum payment is based on a percentage of that balance. Paying this declining minimum is what keeps people in debt forever.

On the other hand, if you fix your payment on this month’s required minimum – if $29 is required this month, you keep paying that amount every month even when the card company asks you for less – you’ll get out of debt much faster.

Fortunately, when you look at the details of the payoff plan Mint creates for you, it’s clear that Mint’s plans are based on an assumption that you will fix your minimum payment at the amount due this month. This is a wise step and one that I have long recommended. Mint should simply do a better job of calling this out. Otherwise, some people may interpret its advice as “pay the declining minimum.”

Final Thoughts

Overall, I like the simplicity of Mint’s new tool, and believe it will help motivate people to pay more than their minimums by easily showing them the benefits of doing so. If you don’t use Mint, or if you prefer to set up an accelerated debt repayment plan that focuses on going after your lowest balance debts first, you could use the free calculator on my site.

Do you use Mint? What’s been your experience?

If someone forwarded this article to you, please sign up for your own subscription to this blog. Two or three times a week, you’ll receive ideas and encouragement for using money well.

Scott – There IS some flexibility in naming categories. In the Budget tab, if you click on “Create a Budget,” you’ll have to choose one of Mint’s pre-determined main categories. But you can then “Add/Edit Categories” to make some changes with the sub-categories. Plus, there is a main Entertainment category. I don’t break down our entertainment spending any further than that. I hope this helps.

Hi Matt –

I was really excited about Mint, but it appears that there’s a major flaw that’s still unfixed. The budget piece is handy, but it doesn’t allow for naming (or renaming) budget categories. I’ve been budgeting using Larry Burkett’s model for years now, and prefer a global label like “Entertainment.” Mint requires lots of sublabels. Bottom line – you can’t create your own budget categories. The online help community shows about 99 folks who have the same concern.

Jessica – Thanks for writing. Great to hear about your experience with Mint, especially how it has helped you become more aware of your spending.

I am a 25 year old newlywed and I don’t feel as if I was taught a lot about finances from my parents. Now that my husband and I are working hard to get our “ducks in a row” when it comes to money, MINT.com was one of the best tools we have found so far. We have smart phones and MINT also has an application that you can put on your phone so we can keep track of your budgets easily from anywhere.

The biggest benefit for us has been that MINT makes us feel more aware of our spending and therefore our spending has decreased. I also like that it shows you the colored meters on how you are doing with your budgets. We still have a lot to learn, but MINT has been great at giving us a little kick start.

I’m having the same problem as Kasey. If I don’t manually enter a check and the receiver of the check holds onto it for a week, my Mint account will still show funds available. While in reality, I’ve already spent the money.

Tracey – Thanks for all of this feedback. The one point I’m especially curious about is what you said about notifications. I’m sending a note to my contact tonight and will leave another note when I hear back.

I have mixed feelings about Mint. They occasionally have connection problems with major institutions that turn into a major wait. Bank of America is what I’m thinking about specifically, but there are others. The occasional connection error is fine – I’d imagine with major security concerns that banks face regarding online banking, there’s going to be a misstep here and there for third party systems trying to access banking customers’ financial data.

But for repeated connection errors, or for people who rely exclusively on a particular institution for their checking, and who want to use Mint but find the system suddenly is useless to them…for weeks…this is not fine.

When this happened to me and I was curious enough to hunt through the Mint Satisfaction forums for an estimate on resolution, I found there was a lot of negative sentiment around Mint being acquired by Intuit. Specifically, that Intuit was letting Mint go to the dogs because they’d rather people purchase Quicken. This does make a lot of sense. Personally, I had been waiting for an announcement that Mint would become a fee service. Then I read a little about the death of Quicken Online and how QO users lost all their data despite earlier promises that it would be merged into Mint…

That aside, Mint has mainly worked well for me, with a few exceptions.

One is that the notifications ONLY work if you regularly log in to Mint. Because unless I’m mistaken, Mint does not update until you log in. This to me defeats the purpose of budget reminders – if I’m THAT on top of things that I’m logging into my budget every day, I think I’d be aware if I went over budget in a particular area, no? Not so useful if I log in say, once a week, go wild with spending during that time, and then receive a landslide of notifications when I finally do log in.

The second is that most of my debt is not supported by Mint. I don’t have credit cards, loans, or a mortgage, because I was so awful with spending for so long that all I have is charged off debt. I make monthly payments on one closed account. I’d LOVE to use the “get out of debt” tool, but Mint won’t let me use it for my “other” debts that I manually set up. It would be nice if those “other” debts were not totally useless – if I could link up my monthly payment and see that balance come down.

Got it, Matt! I suppose I’m used to working the Quicken system – and certainly when I write a check, I’m going to want to notate it so I don’t overdraw my account. And checks can be delayed several days — well, I’ll keep with it. Thanks for your help (repeatedly!)

And just read your post about the book – don’t let it get you down. I’m going to read it, and based on your blog and genuine interest for your readers, I bet I’ll be giving it 5 stars! Hang in there … 🙂

Ah, the plot thickens. One of the main purposes of Mint is to automate things. I believe it’s the fact that you are manually entering transactions that’s messing with the system. The only manual entries you’re supposed to make are for cash transactions. Other than that, you just have to live with a little bit of a delay between when you make a purchase with a credit card, debit card, or check and when it shows up in Mint. But there shouldn’t even be much of a delay.

Try not manually entering anything into Mint other than cash transactions and see how well it works for you.

I hope this helps.

Matt, I’m sorry I guess I’ve been unclear. I don’t only enter cash transactions. Anytime I spend(whether write a check or a CC transaction), I sit down at Mint and push the button marked

” + Transaction”(add a transaction button) so I can keep track of my balance.

Then, when that transaction clears my account, instead of Mint automatically matching the transactions, the transaction is added again, and I have duplicate transactions.

Does that make sense? Do you enter checks that you write into Mint before they clear your account? And when they do clear, does Mint automatically matches them (as Quicken would)?

Thanks for taking another shot at my question!

Kasey – If Mint is working properly — and it sounds like, for some reason, it isn’t working properly in your case — you shouldn’t have to do any manual entry into Mint. Actually, the only manual entries you should have to make are for cash transactions. Again, if it’s working properly, you charge something or write a check for something and when that transaction shows up on your bank’s or credit card’s system, it should show up on Mint.

If I were you, I’d contact Mint directly, tell them about the problem you’re experiencing, and see what they have to say.

Thanks Matt. So when you enter pending transactions and they later clear your account, they are matched automatically by Mint? Strange, that it isn’t working for me like that. And yes, it’s for all accounts. I have searched Mint help and read other’s posts regarding the same problem but it hasn’t been marked as “solved” by Mint so I guess I’ll just hang around and see what happens. I do want to thank you for your terrific blog posts and your prompt replies! Wishing you the best of luck and a wonderful rest of the week! God bless

Hmmm, that’s not good. Here’s the only thing that comes to mind. We once had a credit card where it looked there were fraudulent transactions, so we shut it down and had the company issue us a new card with a different number. For a while, we were getting duplicate transactions because of that. But it sounds like it’s happening for you no matter what method you use to make a purchase. The best I can recommend is that you contact Mint directly. Something’s clearly not right.

Hey Guys,

Thanks for your time in reviewing my question. I’m sorry if I was unclear.

What happens to me is I will enter a pending transaction (a check, a credit card purchase, etc) but when it clears my account, instead of matching the transactions, like Quicken would do, Mint enters the transaction as a duplicate.

So if I’m not quick about catching it, I will have two transactions debiting my account for the same purchase. The pending one I entered and the one Mint enters once it clears my account.

I have to go back to one of the transactions and click the box marked duplicate so that that transaction is not debited twice.

Does that make sense? For me, Mint is not matching up my pending transactions with the actual when they clear my account.

Does this happen to anyone else? Thanks so much!!!

Regarding the earlier discussion about when transactions post to Mint, I just got this info back from the folks at Mint:

Mint will automatically update all accounts when a user logs into Mint via a web browser or through one of our mobile applications. We also update accounts each night, if the user hasn’t logged in that day.

This varies depending on the Financial Institution and how quickly they post transactions to their site. Some banks show immediate pending transactions which Mint will pick up when we update accounts.

This is a much awaited feature! It’s too bad that Mint only prioritizes by interest rate-as a Dave Ramsey fan, my debt snowball goes from smallest to largest amount left on the debt; I agree, it feels great to build momentum!

Martha – Regarding your first comment, that’s one of the thing I like about Mint – my bank account just says I spent “x” at the gas station, but with Mint I can account for the money as it was really spent.

As for Kasey’s comment, you may be right that she may have been talking about when transactions post to her bank vs to Mint, although I believe there’s less of a delay in posting to Mint than there used to be. I’m checking on that with the company.

Matt, after reading Kaseys comment, my thoughts are:

Could Mints “posting timeframe” have something to do with the matching transactions not matching?

Uploading and processing new information takes a minute or two. Uploads can be processed in batches.

Would be interesting to watch the timeframe of when the actual transactions are viewable on the users (Kaseys) side.

Just a thought . . . .

I received my Annual Account Statement from my banking institution and for the most part was pleased. However, the concern I had with “splits”, was for transactions made inside the convenience store of gas stations.

I usually pay at the pump, however if you’re using a debit card vs a credit card, you may be required to “see the attendant”!

The gas purchase (automobile) is not separated from the “goodies”; chips, soda, (groceries). (Will power fades as you enter the door!)

I’m not comfortable with the idea of sharing account info as is requried by the Mint. I do however appreciate a system which can give me a clear picture my current financial balances . . . which only works if I monitor it and am faithful to keep watch daily!

I like this article and thank you for sharing it!

Kasey – I’m not sure I understand your first question about Mint not matching transactions. Can you give me an example?

As for the split feature, I think it does do what you want it to do, unless I’m misunderstanding your question. For example, I sometimes split transactions that the system automatically categorizes as groceries. Maybe we spent $100 at target — $90 on groceries and $10 on greeting cards. If I didn’t split it, it would say we spent $100 on groceries. But when I hit the split button, it’ll show “Target,” “Groceries,” and “$100” across the top. I can’t edit that. But in the first box that I can edit, I put “Groceries” and “$90.” Then, after I hit “Split,” it’ll show me I have $10 left to account for at the bottom. So, I fill in the next set of boxes with “Gifts” and “$10.” Then I save it and I’m done.

As you split the transaction, you should see how much you have left to account for at the bottom. Does that help?

I’ve started using Mint exclusively in Jan moving away from Quicken which I used for several years. I like the real time updates on my accounts, but there are a few things I don’t like. For example, Mint doesn’t match transactions I’ve entered when they clear my bank account. Am I missing something? I can’t seems to make that work and then have to check the “duplicate” box to make sure my balance is correct. The split feature is also bothersome as it doesn’t keep a running tab of how much each split comprises of my balance. Quicken, for example, has a little calculator feature that helps with the split task. Those are my thoughts. Maybe someone has a quick tip?